As featured in the QHA Review

Earlier this year, AUSTRAC, Australia’s anti-money laundering and counter-terrorism financing (“AML/CTF”) regulator, started an awareness campaign focused on the importance of anti-money laundering, combating the financing of terrorism, and completing compliance assessments. To date, AUSTRAC have visited over 500 pubs and clubs across Australia who have a licence to operate electronic gaming machines (“EGM”) to ensure an understanding exists of the need for compliant AML/CTF programs. Following this educational campaign, this will potentially lead to compliance investigations and fines being issued to pubs and clubs, as has been seen with casinos in the past.

What Are the Regulations?

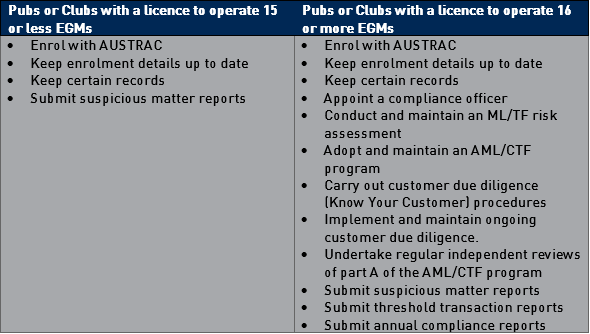

The Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (“the Act”) aims to combat money laundering and terrorism financing. The Act required pubs and clubs to report transactions and suspicious activities to AUSTRAC and take steps to prevent their business from being used by criminals. The specific obligations for pubs and clubs will depend on the number of EGM entitlements they have under their licence to operate, regardless of how many EGM’s are actually in operation.

If the pub or club has a licence to operate 15 or less EGMs, it may be exempt from certain obligations, including having an AML/CTF program, customer due diligence, and submitting certain reports to AUSTRAC. However, the pub or club will still be required to enrol with AUSTRAC and report suspicious situations. Below is a breakdown of the general requirements depending on the gaming licence:

What Are the Consequences of a Breach?

AUSTRAC have a number of enforcement actions that include (but are not limited to):

A direction/requirement to comply with certain parts of the Act;

- Infringement notices for contraventions of some obligations, such as customer identification procedures and record keeping;

- Notice for the pub or club to appoint an external auditor to review AML/CTF compliance, undertake a money laundering assessment, or provide AUSTRAC with information about meeting AML/CTF compliance;

- An enforceable undertaking by the pub or club to AUSTRAC of how AML/CTF compliance obligations will be met in future; or

- An application for a civil penalty order against the pub or club.

The Mullins Hospitality team can help you understand your obligations when it comes to AML/CTF. With a potential crackdown looming on pubs and clubs meeting their AML/CTF obligations, we can assist with ensuring your compliance requirements are being met. Please give me a call on 07 3224 0230 to discuss further.