Anyone that practices in estate planning or estate administration needs to urgently familiarise themselves with the recent legislative changes to the Foreign Acquisitions and Takeovers Regulation 2015 (Cth) (Regulations).

From 1 January 2021 (as in, right now!), an amendment to section 29 of the Regulations means that an acquisition of an interest in securities, assets, a trust, or Australian land that is acquired by will is no longer exempt from the FIRB Regime.

For example, if a foreign person (as defined by section 4 of the Foreign Acquisitions and Takeovers Act 1975 (Cth) (the Act)) inherits real property from a deceased person, that beneficiary will need to comply with the FIRB Regime before the property can be transferred to them.

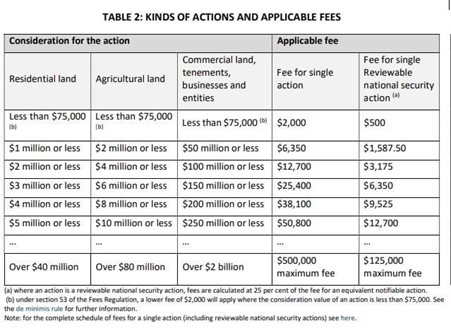

The FIRB fees are significant and would be payable by the beneficiary:

In this example, if the beneficiary does not want to go through the FIRB process or does not ultimately obtain FIRB approval, then the beneficiary and the Legal Personal Representative will have to consider alternative options, such as:

- Referring to the Will to see if there are any clauses that would assist (such as a conditional gift clause);

- The beneficiary disclaiming the gift;

- The sale of the property; or

- Some other arrangement agreed to by the beneficiaries of the estate.

All these options may trigger different revenue and other taxation consequences for the Estate and/or the beneficiary in question.

This issue will be best dealt with by proper estate planning to ensure that appropriate clauses are included in the Will to handle the situation where a beneficiary is, or may be, a foreign person at the date they become entitled to a gift of applicable property.

This is yet another reason why proper estate planning (even the drafting of “simple” wills) and Will drafting must be done by an expert estate planning lawyer.